While the first year of the Covid-19 pandemic might have brought cryptocurrency into the mainstream, 2021 has arguably been the breakout year for wider applications of blockchain technology.

The initial frenzy was focused on how blockchain was reinventing the art world through NFTs, but its influence was already building gradually in the sports industry.

The basics: how is sport getting into blockchain?

First, a definition: a blockchain is a digital ledger which records information so that it cannot be altered or erased, maintaining an indelible record of transactions in “blocks” across a linked peer-to-peer computer network.

Blockchain technology is already being used within sports in a variety of ways. The application which has spread fastest geographically and across sports has been the creation of fan tokens, a form of cryptocurrency which can be acquired by sports fans directly or in exchange for platform-specific cryptocurrencies. These allow holders a variety of membership perks like voting in fan-oriented polls, rewards, merchandise designs and unique experiences. Since their emergence early in 2020, fan tokens have amassed a market cap of close to $0.5 billion, according to FanMarketCap.com.

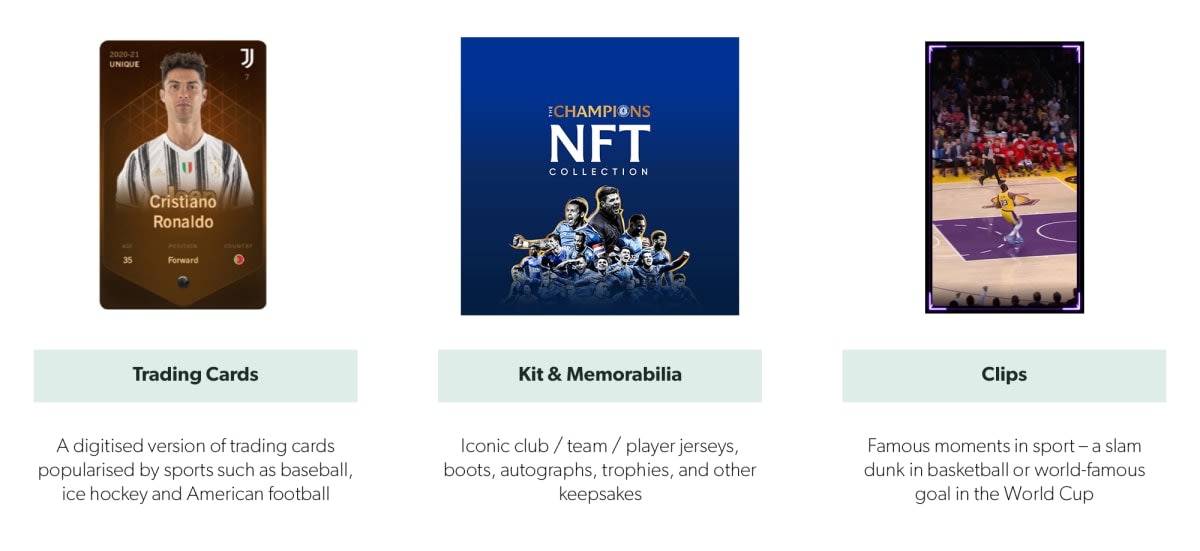

The sports Non-Fungible Token (NFT) is perhaps most easily understood as a reinvention of the sports collectible – a “baseball card for the modern age”. NFTs are unique and non-interchangeable units of data stored on a digital ledger that uses blockchain technology to establish proof of ownership, which can be bought and sold like any other asset, and acts as a store of value. In terms of major players, the NBA has led the charge into the sports NFT market with the launch of NBA Top Shots in June 2020, of which sales have reached $800m.

NFTs have also moved into Fantasy Sports, already a sector experiencing rapid growth following the legalisation of sports betting in the US starting in May 2018. Blockchain-enabled NFTs are acquired through online marketplaces and build a player’s advantage in the fantasy game, with trading value linked to gameplay value. Sales of player NFTs for Sorare’s fantasy football (soccer) game have reportedly topped $150m since April 2019.

Fan tokens: digitising fan engagement

Fan Tokens are cryptocurrencies that allow holders to access fan-related membership perks such as voting on club decisions, rewards and unique experiences. The market leader is Malta-based Socios, which has launched tokens for around 30 European football clubs, around half of which are in the “Big Five” (though only one in France and none so far in Germany). Aside from a limited number of free tokens offered to the season ticket holders of some clubs, tokens can only be purchased with Socios’s own “alt-coin” Chiliz, which itself must be purchased with fiat currency on a cryptocurrency exchange.

Benefits offered to token holders have primarily been access to vote in polls on matters designed to engage fans, such as picking a message to be displayed on the captain’s armband, goal celebration music and designs for the team bus. Other entrants to the market are Turkish company Bitci, whose European football partners are primarily in its native Turkey but also include Scotland’s Rangers, three other clubs and the national team in Spain; and Binance – the world’s largest cryptocurrency exchange founded in China but since moved to the Cayman Islands – which has launched tokens for Lazio in Italy, FC Porto in Portugal, and Santos in Brazil.

There is no shortage of rights holders creating partnerships with the fan token platforms. So far, the roster includes 19 clubs from European football’s Big Five, with Fan Token Offerings (FTOs) planned for a further eight clubs; 22 clubs from other European leagues and six from South American leagues; seven national football teams across Europe and South America; and a variety of others across basketball, motorsports, eSports and combat sports.

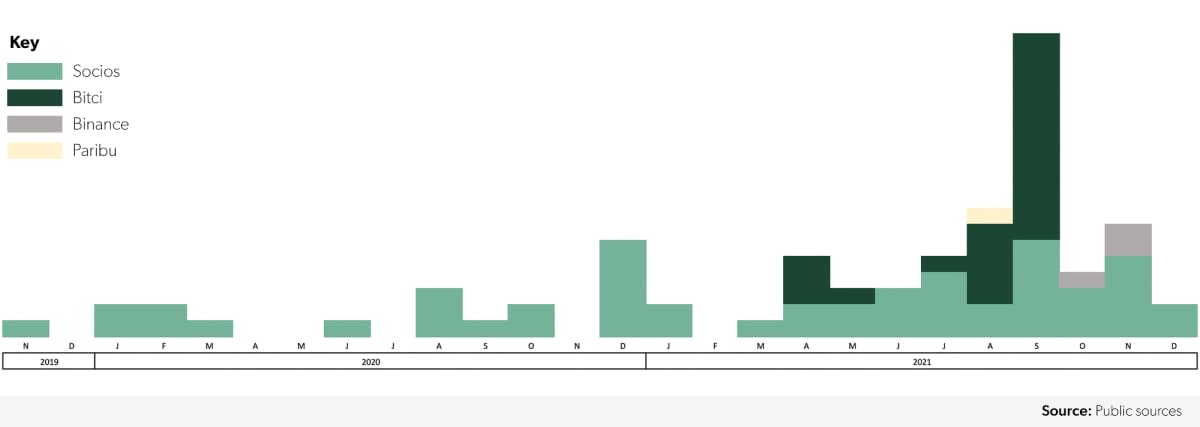

The launch of sports fan tokens accelerated dramatically in the second half of 2021

Fan tokens have come in for some criticism. The monetisation of fan support has been viewed as cynical by supporters’ clubs and national fan associations (a backlash from West Ham supporters led the club to end its partnership with Socios before launching their token), though others have argued that the engagement opportunities are primarily targeted at international fans with limited opportunities to connect with the club from afar.

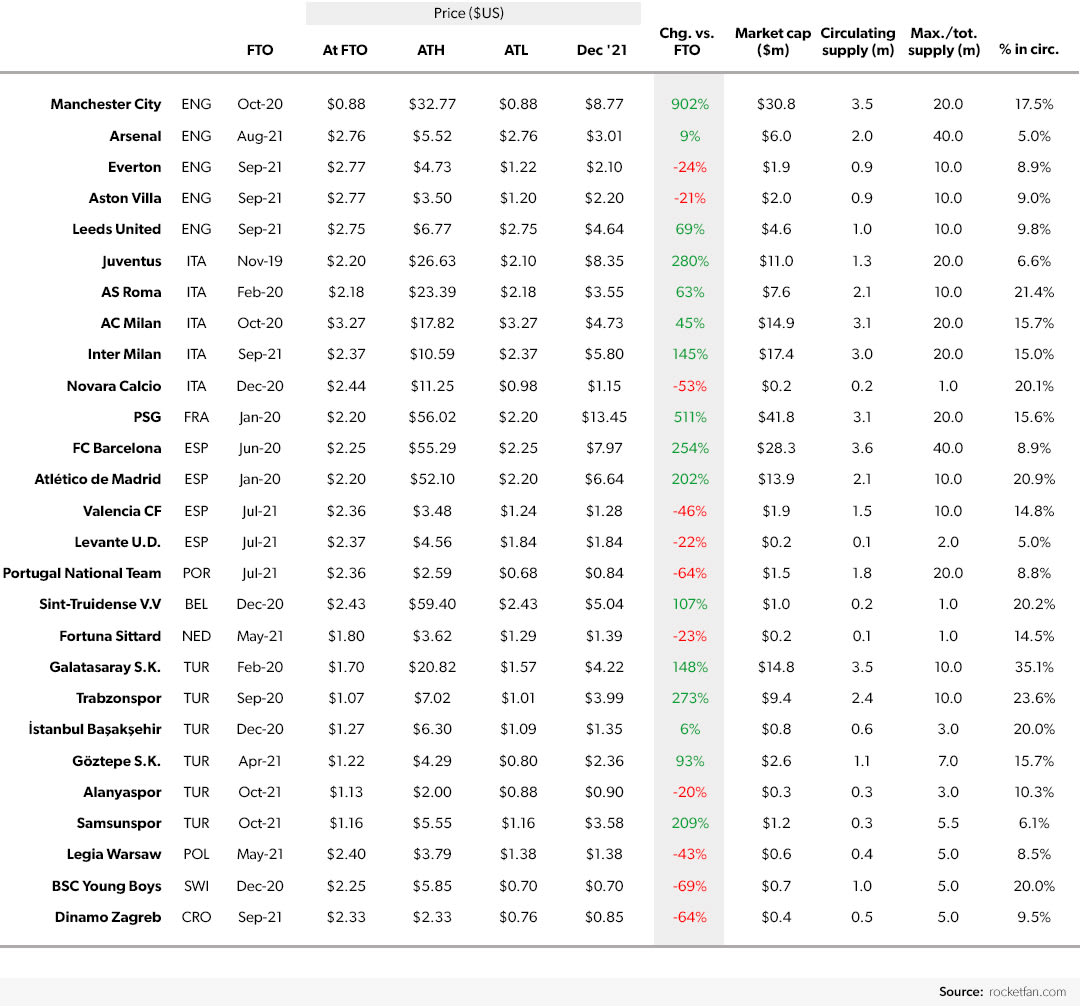

The price fluctuation of most fan tokens would score highly on any volatility index. AS Roma’s token climbed from $3.10 to $23.39 in two weeks in December 2020, before collapsing to $2.98 two weeks later, while Atletico de Madrid’s rose from $9.89 to its all-time high of $52.10 over 10 days in May 2021, before falling to $17.65 two days later. Within European football, it is the largest clubs (e.g. Manchester City, Juventus, PSG, Inter Milan, FC Barcelona and Atletico de Madrid) whose tokens have seen the strongest growth, while some of those of smaller clubs or in minor leagues have been subject to significant falls post launch.

So far, the number of tokens issued through each partnership has been limited. Of the theoretical maximum of 318.5 million tokens issuable by the clubs and national teams in the below table, 40.6 million (12.8%) have so far been released. Issuing further coins might generate further revenues but increasing the supply is also likely to impact the price of those already in circulation.

The prices of European football fan tokens have seen dramatic moves since launch

The NFT revolution – digital collectibles

NFTs are unique and not replicable, which is precisely the case for limited edition sports collectibles. The uniqueness offered by blockchain technology has been recognised as a way for sports rights holders to tap into and monetise fan engagement. With the tokenization of sports moments or trading cards, fans can claim ownership of favourite athletes or moments, and seek to generate investment returns by trading smartly based on sports knowledge.

For NFTs to be traded between collectors, access to a marketplace is required, and these have sprung up in huge numbers over the past three years. Marketplaces have been launched by major rights holders to handle their own NFTs – for example NBA Top Shot, developed in partnership with Dapper Labs – also partnering with the NFL on the soon-to-be-launched NFL All Day marketplace. Others have chosen to launch via general NFT marketplaces, such as the Golden State Warriors NBA team and former Brazil left-back Roberto Carlos – both on OpenSea, and Manchester City on Makersplace. There are also collective marketplaces such as Realfevr or Zilstars which offer a variety of cards, clips, and autographs of a select group of football players both past and present. On all marketplaces, purchases are generally made with cryptocurrencies, although some allow the use of fiat currencies too.

Since launching in June 2020, NBA Top Shot has seen more than 800,000 individuals trading around $800 million of exclusive, officially licenced NBA digital collectibles. Sales peaked in February 2021 at $224 million from 81,000 unique buyers and featured the record sale to-date: a LeBron James slam dunk purchased for $210,000.

Importantly, owning an NFT clip from a sports match does not always mean ownership of that recorded highlight from the game, but often a collectible digital version of it. Caty Tedman, Head of Partnerships at Dapper Labs explains that, “you don’t own that highlight that you watch. You don’t have any rights to commercialise it in the way that you can sell it to somebody else in its entirety”. While owners can sell NBA Top Shots they own, they are prohibited from commercialising the highlight clip from which it is built, for example by charging a network to use the footage. In this way, rights holders such as the NBA are able to package up and monetise match content without giving up any property rights over the original broadcast material.

With baseball and ice hockey being sports central to the creation and market in physical trading card collectibles, it perhaps makes sense that the MLB have launched NFTs in partnership with Topps, a manufacturer of those physical cards, and the NHL are soon to follow with another traditional card company, Upper Deck. While the global market in physical sports card and memorabilia is estimated to be worth $5.4 billion and physical cards still trade at values many multiples higher than NFTs (e.g. a 2003/04 season autographed LeBron James Upper Deck card sold for $5.2 million in April 2021, twenty-five times more than the purchase price of the above mentioned LeBron James slam dunk NFT) these companies are arguably wise to hedge their bets by being quick to develop digital collectible offerings and secure partnerships with major rights holders.

NFTs augmenting fantasy sports

With the four major US sports all setting out their stalls in the NFT market, the leading power in European football NFTs is Sorare, which combines an NFT marketplace (which is also listed on OpenSea) with a fantasy football game. Founded in France in 2019 and backed in its $50m Series A by Antoine Griezmann, Rio Ferdinand, and Oliver Bierhoff, Sorare brings a blockchain twist to fantasy football: rather than selecting a team of players from a single league to fit within an allocated budget, members build a team of player NFT cards from the available selection of licensed teams around the world, to compete in a range of leagues.

Some cards are “common” and cost nothing, while rarer cards can be acquired through the marketplace. The level of scarcity of paid-for cards runs from Limited (1,000 copies) through Rare (100) and Super Rare (10) to Unique (1) – meaning only 1,111 new cards are “minted” per player per season. A card’s scarcity influences its market price, while the right to play in specific leagues is based on ownership of rarer cards. An owner’s score in the fantasy game can be augmented through a bonus system, which takes into account the season the card was minted, its rareness level and the experience points (XP) which are accumulated through usage in the game. In-game rewards include rare cards and ether (ETH) cryptocurrency, with which new cards can be bought in the marketplace.

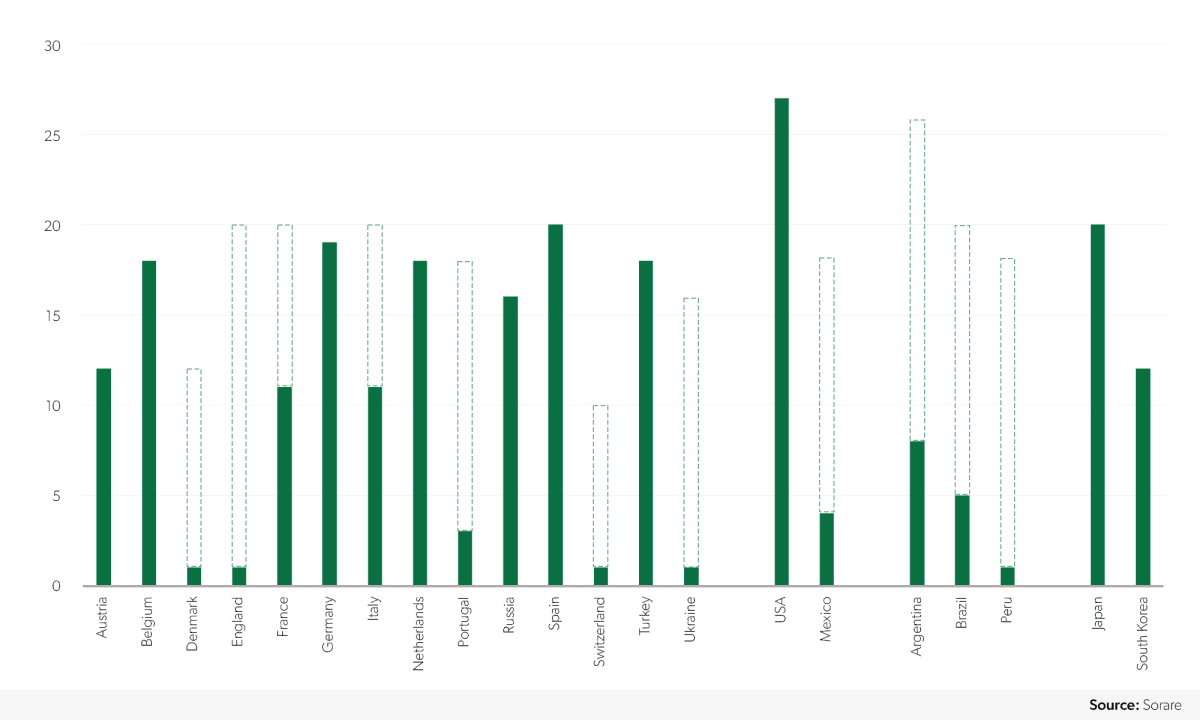

Sorare certainly appears on track to corner the fantasy market in the world’s most popular sport, given the coverage it has already reached through licensing agreements. Amongst the 228 clubs already signed, 150 are European clubs including all members of the German Bundesliga, Spain’s LaLiga and the top divisions of Austria, Belgium, the Netherlands, Russia and Turkey, as well as 11 each from Italy and France and three Portuguese sides. The Premier League is notably absent (although Liverpool FC have signed an individual club agreement) but is rumoured to be in discussions to join up in full.

In the countries where Sorare has at least one license, 60% of top-division football clubs have signed up

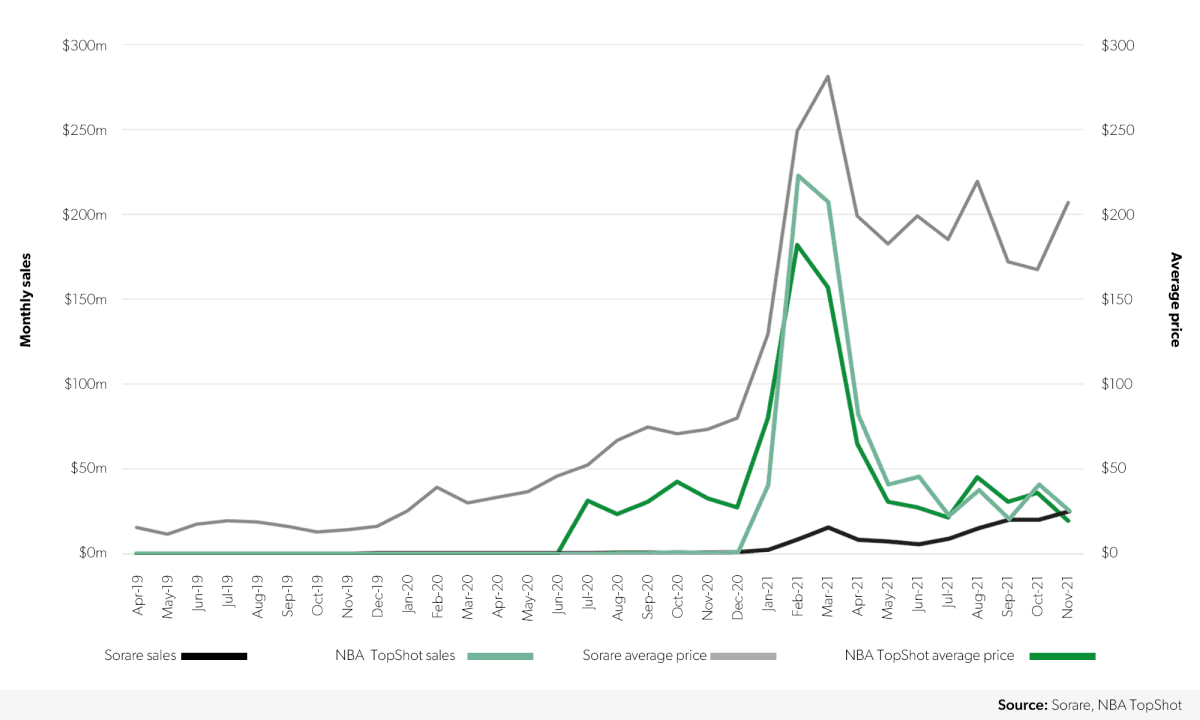

Sorare sales have grown gradually since launch to surpass $150 million reportedly from more than 800,000 transactions. While NBA TopShot has sold more than five times that volume, sales have slumped following an impressive peak in February and March and are expected to be lower than Sorare’s in the month of December. Moreover, the average sale price of a Sorare NFT ($199.0 in 2021) is more than three times higher than an NBA Top Shot ($59.5) and has not experienced as dramatic a fall from its March peak of $280.0 as Top Shot did from its February high of $180.0. The record sale price for a Sorare NFT was just under $290,000 for a unique Cristiano Ronaldo 2020/21 card in March 2021, 40% higher than the LeBron James clip sold the previous month. In September 2021, it was announced that Softbank’s Vision Fund 2 had led a $680 million Series B funding round which valued Sorare at $4.3 billion.

Sorare NFTs have maintained a higher average sale price than NBA Topshot

Outside of football, market-leading fantasy sports operator Draft Kings has announced the creation of “gamified” NFT collections of NFL players for a fantasy game for the 2022/23 season. Meanwhile the REVV Motorsport blockchain created by Animoca Brands has established official partnerships with Formula 1, MotoGP and Formula E, with all editions providing the opportunity to buy NFTs (unique cars, drivers and components) for in-game use and earn new NFTs and REVV currency tokens based on performance. While volume is on a smaller scale than Sorare or NBA Top Shot, F1 Delta Time commands an average NFT sale price of $649. A unique Master Formula 1 Grand Prix de Monaco 2020 1A sold for $272,353 in December 2020.