On April 7 the 2022 MLB season gets underway, a week later than originally scheduled due to protracted negotiations on a new Collective Bargaining Agreement for 2022-28.

Baseball is widely seen as America’s third sport after American Football and Basketball, but the MLB actually boasts the highest attendance of any sports league in the world, with total regular season crowds averaging 72 million in the five seasons up to 2019. Around 7,500 hours of play are clocked up each season, with every team playing 162 matches (with additional games for those making playoffs) – twice as many as teams play in the NHL and NBA, four times as many as top-tier European football clubs and ten times as many as played in the NFL.

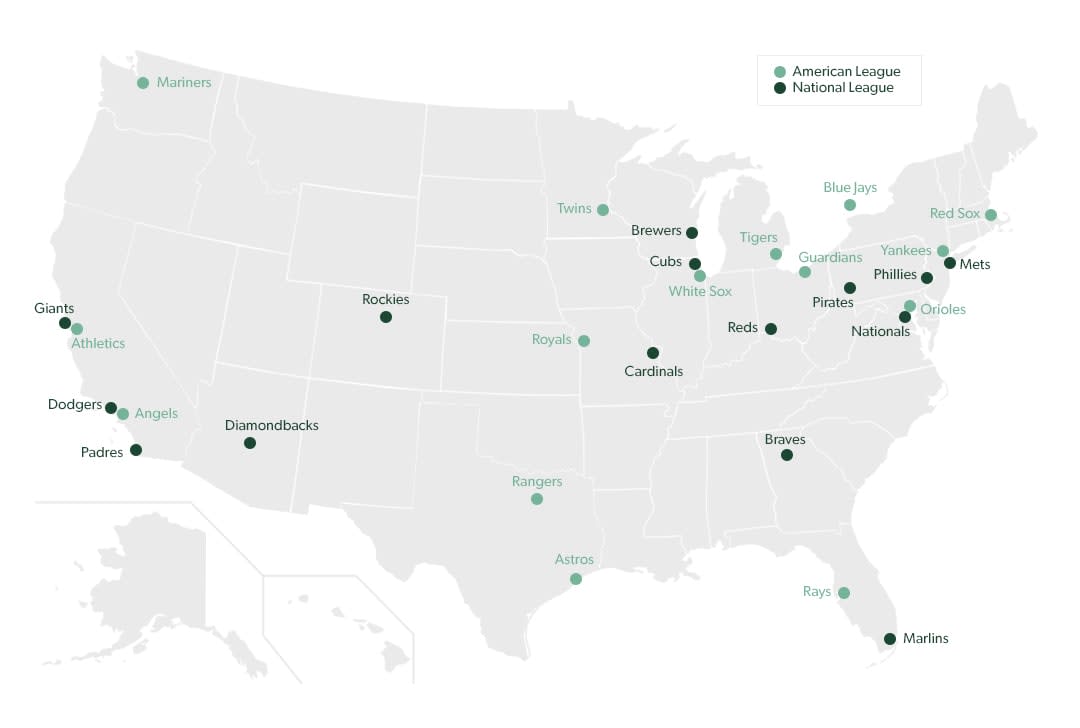

There are 30 Major League Baseball teams, split into two leagues – the National League and the American League. The sport’s geographic core is in the Northeast and upper Midwest, where there were once two major teams in cities such as Philadelphia, Chicago, St Louis and Boston and three in New York. Gradually franchises were established in the western half of the country, and during the 1950s and 1960s several major teams relocated – including two of those in New York which went on to become the San Francisco Giants and the LA Dodgers – but the centre of gravity remains in the Northeast.

The MLB remains heavily weighted to the Northeast and upper Midwest

Consistent, strong revenue growth

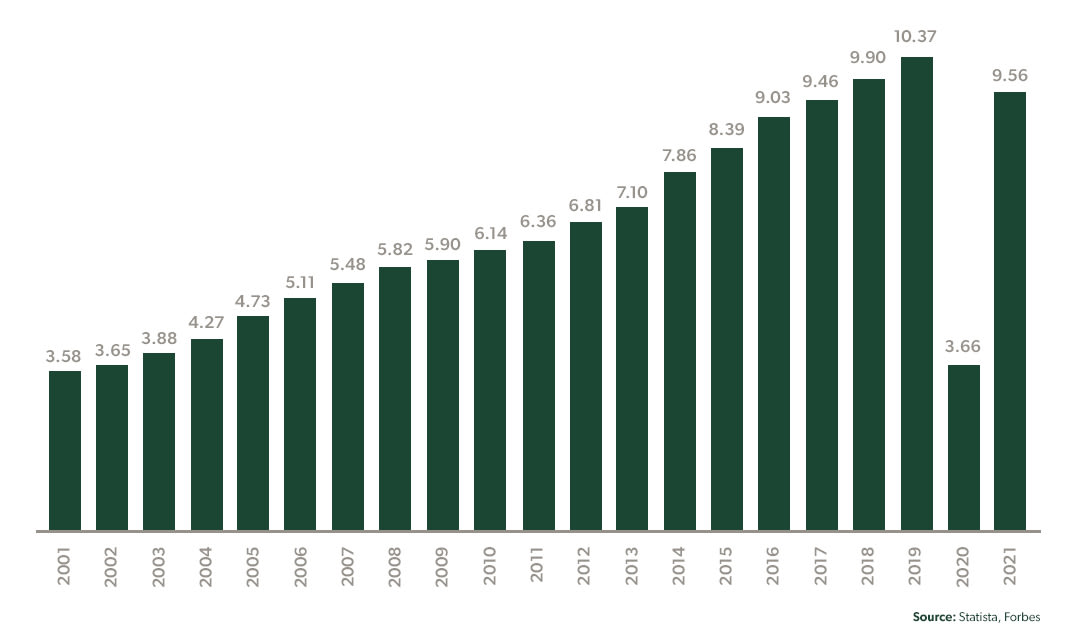

Within the two decades to 2019, total MLB revenues nearly trebled, from $3.7bn in 2002 to $10.4bn in 2019, with average annual growth of 6.0% in that period. In 2020, revenues fell 64.7% to a combined $3.7bn as the regular season – due to start on March 26 as the first wave of Covid-19 was sweeping the world – was postponed and subsequently reduced from 162 to 60 games, with spectators entirely absent until the latter stages of the playoffs.

Revenues of $9.6bn in 2021 were 7.8% shy of 2019 levels but represent a good result considering that restrictions limited average attendance to 18,900 per game, down a third from 2019’s average of 28,317. Stadium attendances had actually been in decline for the seven years up to 2019, declining around 1.2% per annum since the 30,883 average of 2012; the strong top line growth points to growth in ticket pricing and the development of other revenue streams.

2021 saw MLB revenues reach 92% of pre-Covid levels

Forbes 2022 valuations up 9% driven by new TV contracts and sponsorship revenues

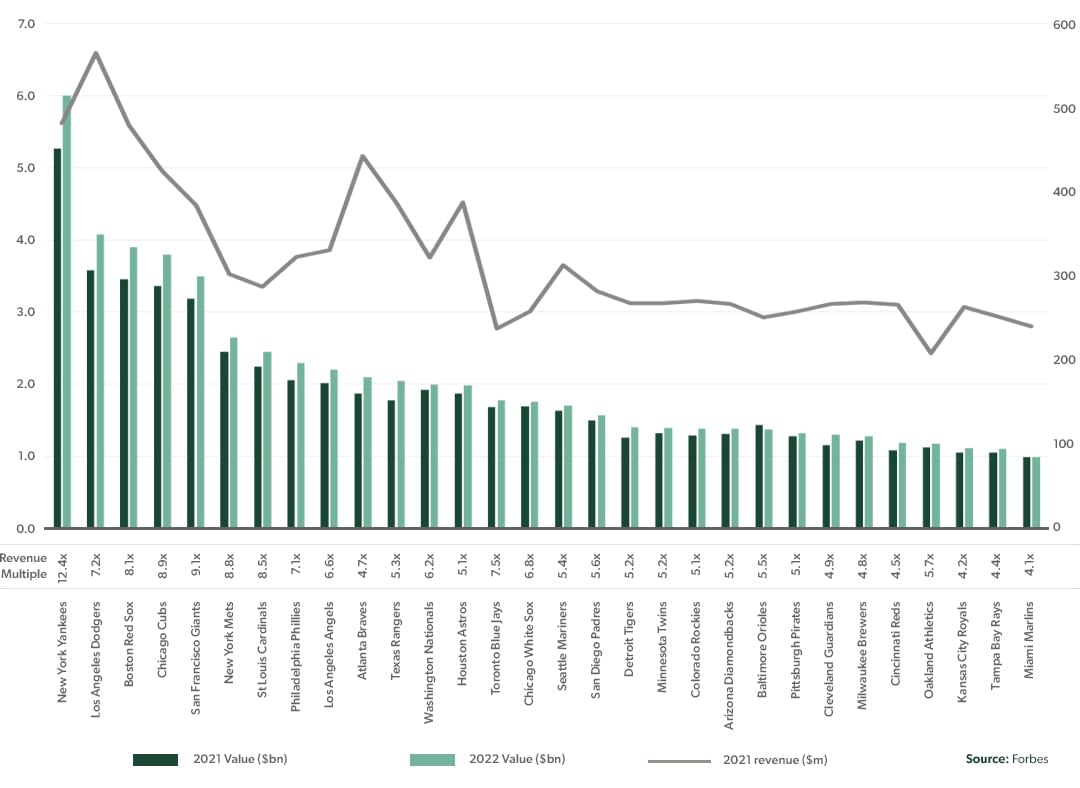

Forbes published its 2022 valuations for MLB teams on 24 March, reporting an overall one-year increase for the league of 8.9%. The New York Yankees of the American League are the first team in baseball reach a value of $6bn and trail only the Dallas Cowboys ($6.5bn) amongst the world's most valuable sports franchises. Despite this standout valuation, teams in the American League are collectively valued at $30.2bn compared with the $32.0bn of the National League.

From a revenue multiple perspective, the MLB is valued at 6.5x 2021 revenues. The New York Yankees again top the pile at 12.4x while at the other end of the scale, the Miami Marlins value of $1.0bn represents a multiple of 4.1x on 2021 revenues of $240m. The highest revenues in the league - $565m in 2021 – were reportedly secured by the LA Dodgers, whose value is estimated at $4.1bn yielding a multiple of 7.2x.

MLB team valuations range from 4.1x to 12.4x revenue multiple in 2022

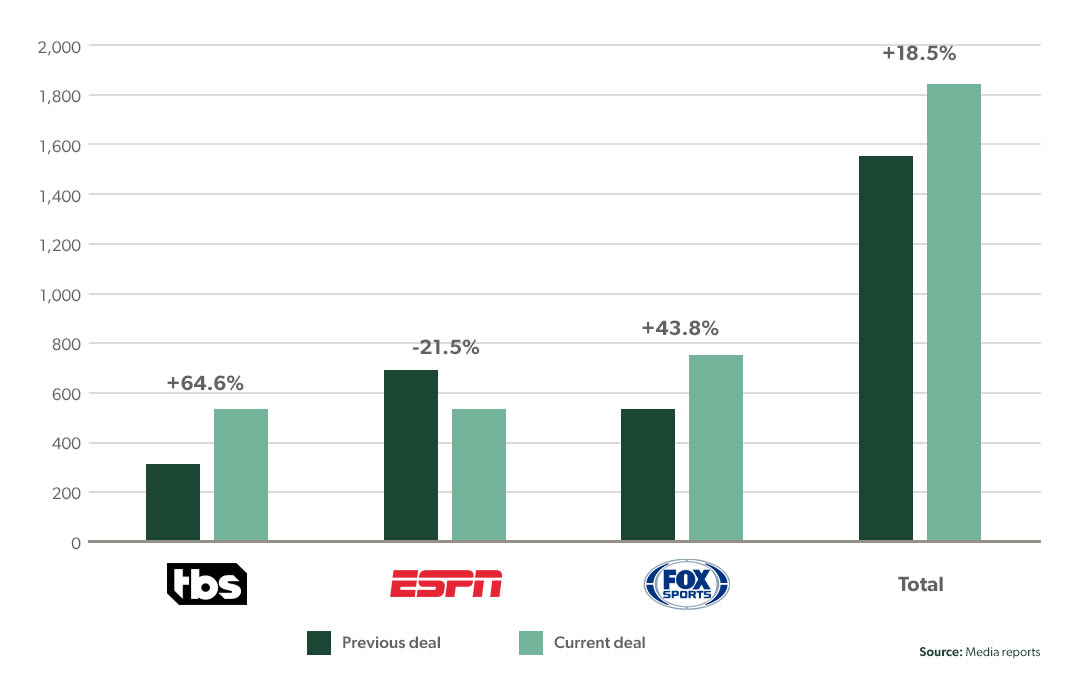

A contributor to franchise value growth has been the increase in domestic broadcast contracts for the 2022-28 cycle, which were up 18.5% collectively on the previous deals. A new agreement with Fox Sports was concluded in November 2018, followed by Turner Sports (owned by WarnerMedia) in November 2020 and ESPN (part of the Disney group) in May 2021. The latter reduced investment by 21.5% on the previous deal as it downgraded coverage of regular season games, but the deal represents an increase on a per-game basis; while the slack was picked up by Turner and Fox. A three-year streaming deal with streaming service DAZN was also agreed – the first domestic major league sports property for DAZN in the US.

Domestic MLB TV deals increased 18.5% for the 2022-28 cycle

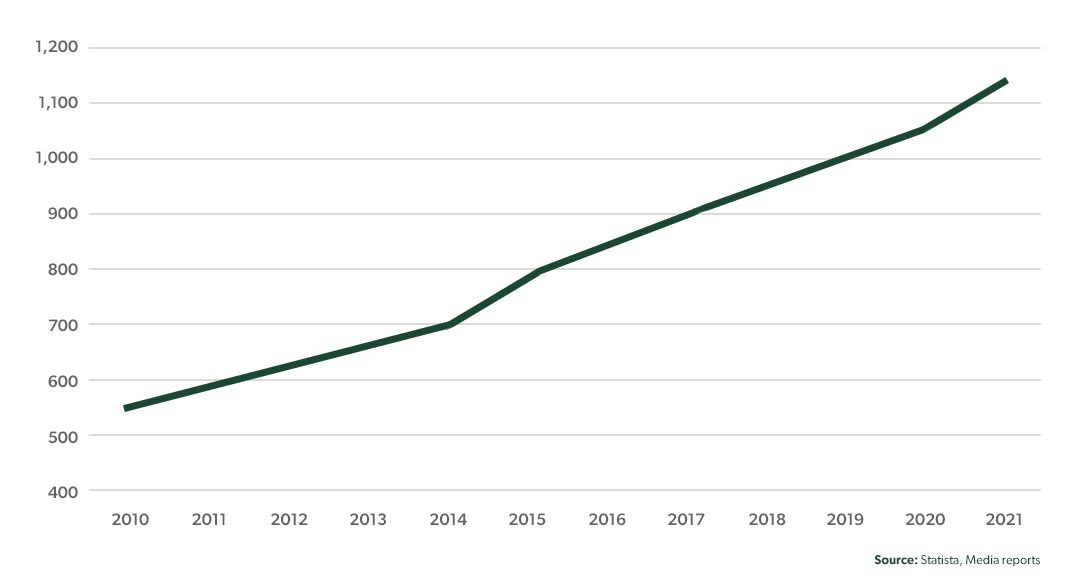

Sponsorship revenues, estimated to have grown 6.8% annually since 2010, have been another significant driver of growth. According to sponsorship measurement company IEG, the estimated $1.1bn revenue in 2021 ranks third in sport behind the NFL’s $1.8bn and the NBA’s $1.5bn, and comes from 990 individual brands participating in 1,640 agreements. Two stadia took on new naming rights deals in 2021 (Miami’s Marlins Park became LoanDepot Park and Milwaukee’s Miller Park became American Family Field); there remain eight MLB stadia without a sponsor, including those of the Yankees, Dodgers and Cubs, compared to only three for the NFL and one (Madison Square Garden) in the NBA and NHL.

Overall top spenders on MLB sponsorship in 2021 were traditional categories of banks, beer, insurance, apparel and automotive, with the top three spending brands being Bud Light/Budweiser, T-Mobile and Nike. Starting in the 2023 season, clubs will have a new lever to pull, after helmet decals and jersey advertising patches were approved in the new Collective Bargaining Agreement. The average deal is expected to bring in around $10m, with the sport’s bigger brand names potentially being able to command more than twice that amount.

MLB sponsorship revenues have grown 6.8% annually since 2010

Players rewarded in new Collective Bargaining Agreement

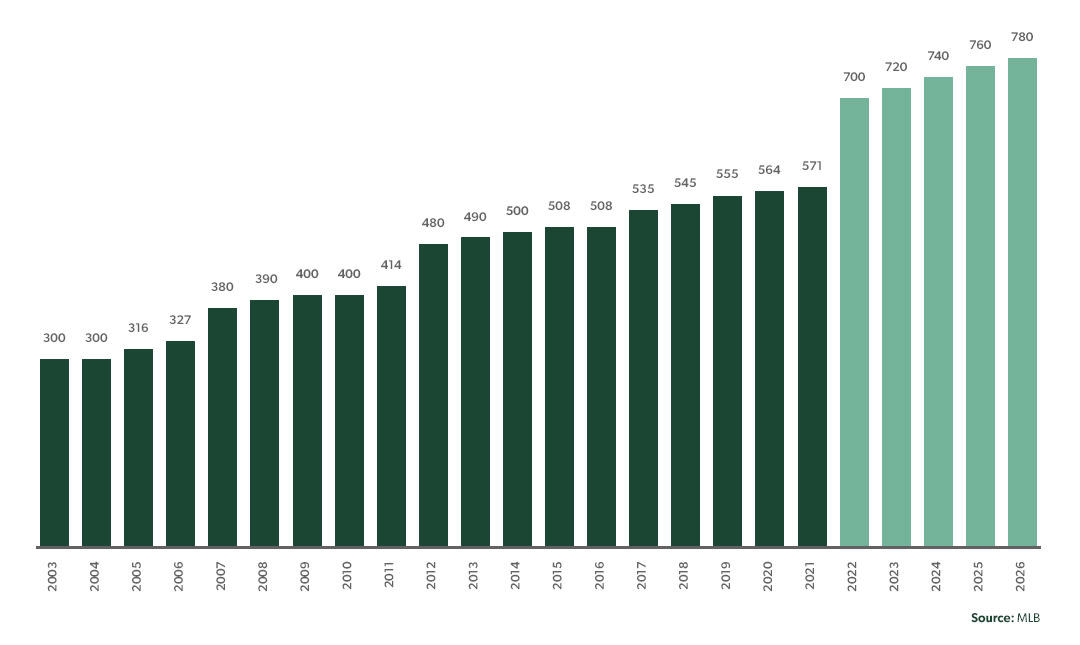

With solid increases in TV and sponsorship revenues, the Players’ Association (MLBPA) worked hard to ensure its members will be well remunerated over the five-year period of the new Collective Bargaining Agreement (CBA). The first-year increase to minimum salary negotiated for the new CBA is the largest single-year increase in history at $129,500, nearly five times larger than the $27,500 increase in the first year of the prior CBA. It also represents a larger increase than the total from the past 10 years. Minimum salaries will continue to rise at $20k per annum through the period, reaching $780k in 2026.

The Competitive Balance Tax threshold was also increased in the new CBA, meaning teams can spend up to $230m on player salaries in 2022 before being subject to fines for overspending (up from $210m in 2021), rising to $244m in 2026. Taxes imposed on teams spending more than the threshold increase when this occurs over multiple consecutive seasons, and a new level of taxation has been added in the new CBA for teams spending $60m or more over the limit.

The MLB minimum salary jumps $129,500 in the first year of the new CBA, an increase of 22.7%