The popularity of women's football has grown dramatically in recent years, driven by increased professionalism and greater participation and showing in higher attendances and viewership numbers.

Interest has grown over recent years due to increased broadcasting viewership and attendances at major international tournaments, notably the 2019 FIFA Women's World Cup. The finals in France brought greater attention to the domestic women's game, leading to an increase in broadcasting and sponsorship deals negotiated for women's club competitions. Broadcasting deals such as that between Sky Sports and the BBC and the Women's Super League (WSL), and UEFA's decision to unbundle broadcast and sponsorship rights from men's tournaments represent positive steps forward, increasing revenues for women's teams and allowing the game to grow.

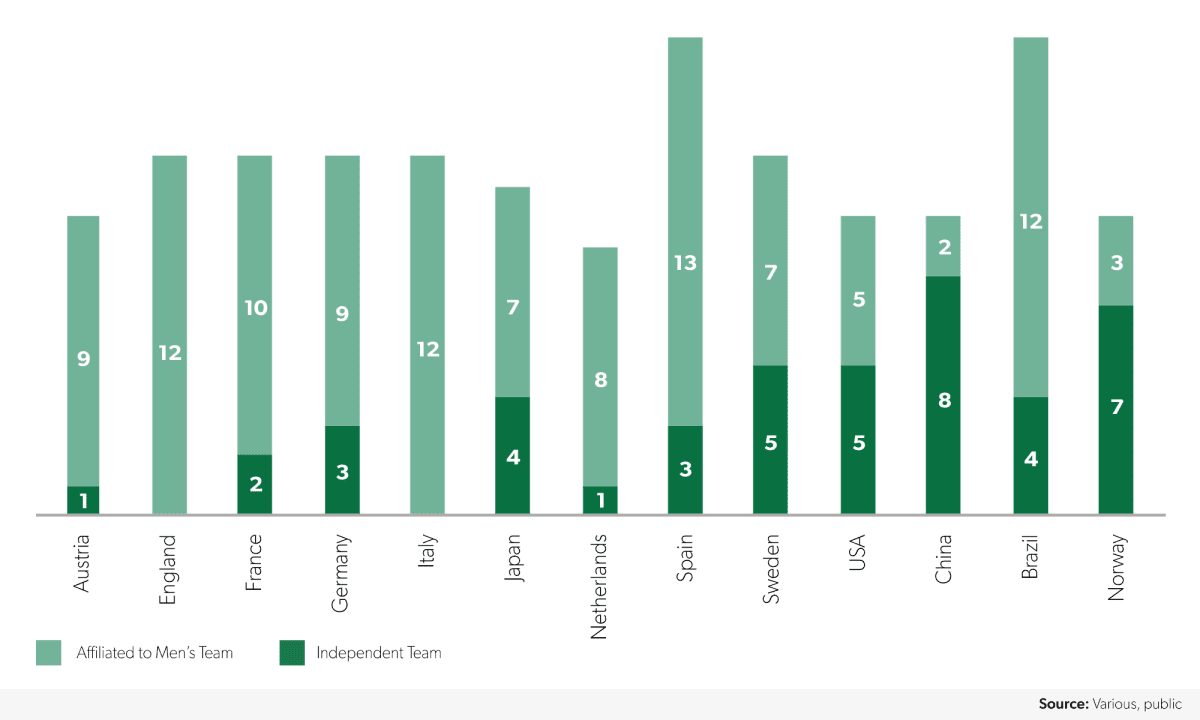

However, the structure of the game is currently modelled around men's football, with many women's teams affiliated to men's clubs. While this has the advantage of providing a “ready-made” supporter base for the women's team to engage, it does not necessarily mean the creation of dedicated infrastructure or quality facilities for elite development. Despite the positive commercial growth and interest levels into women's football, questions have been raised surrounding its current governance model.

The Fan-Led Review of Football Governance in the UK led by Tracey Crouch MP recommended increased investment, as well as a dedicated review into the women's game. It describes a ‘culture of dispensability and short-termism' and argues that the existing infrastructure has been stretched by women's football's commercial growth, stating that women's football faces ‘multiple, interconnected challenges', primarily regarding infrastructure and governance within the game. To alleviate these challenges, changes in the governance model should be considered, including the introduction of more independent teams unaffiliated from men's clubs.

Interest in women's football is increasing but the international game leads

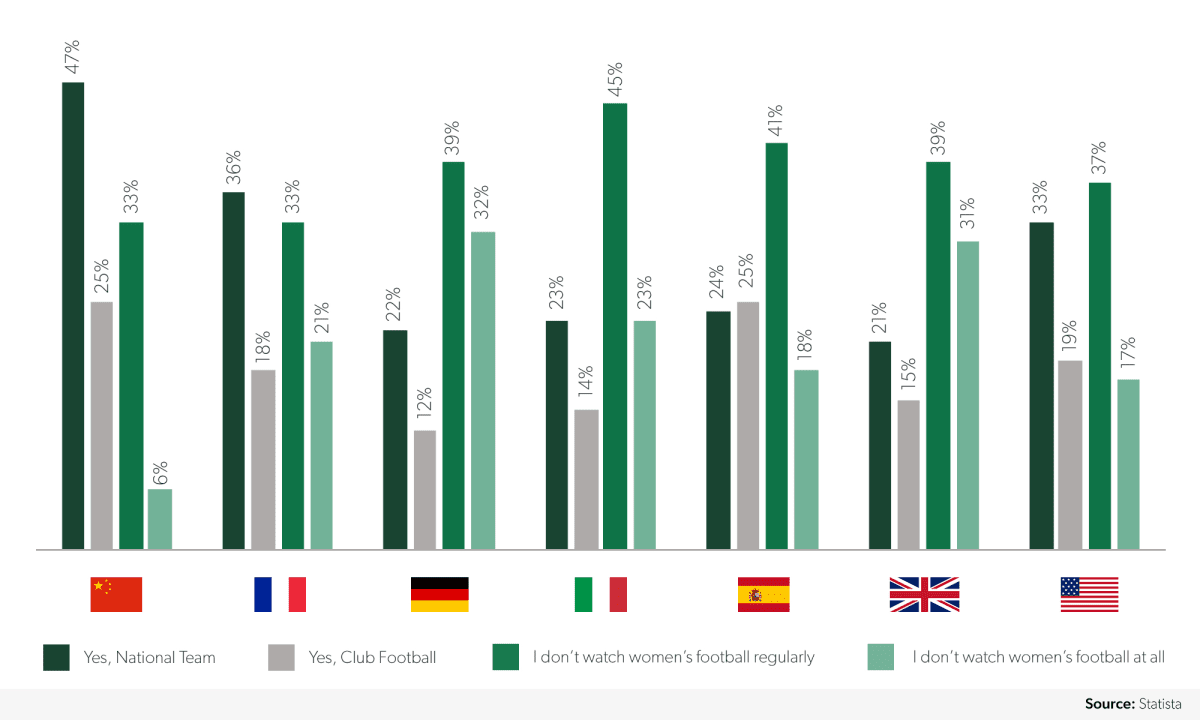

Data suggests that interest in women's football has increased in recent years. International matches are the primary driver: according to YouGov, 42% of people became interested in women's sport after watching international events. A gulf in interest between national and domestic competitions remains, although the gap is smaller in the UK and interest in Spanish club football has actually surpassed interest in the women's national team.

A significant gap in interest levels exists between international and domestic football in most markets

Where there is a lack of engagement with women's sport, it tends to stem from issues in broadcasting supply. In YouGov's survey, 40% of sports fans report that a key driver is a lack of media coverage (reporting/highlights) while 27% say they cannot easily find games to watch on TV or online. For 24%, the coverage is not of sufficient quality. Such issues can be alleviated with increased broadcast visibility brought about by new television and OTT deals, and investment into production values.

From a demographics perspective, women's football is more attractive to younger audiences, while 46% of the audience is female compared with 38% in than for the men's game. These differences provide opportunities to deviate from the men's football governance template.

More men watch women's football than women, but the fanbase tends to be younger

An infrastructure challenge?

Most major league women's teams do not have their own training facilities, relying on those of affiliated men's teams and often sharing with men's youth teams. While 68% play in a different stadium to their men's teams, again these are frequently shared with development squads and have lower capacities than men's stadia. As a result, 75% of women's football leagues have an average attendance of less than 1,000.

Domestic women's football match attendance is in general significantly lower than for international fixtures, despite encouraging growth in major leagues. The highest attendances for women's matches are set in men's stadiums, the current record being 60,737 for Atletico Madrid vs. Barcelona at the Wanda Metropolitano, underlining the current dependence of the women's game on men's football.

“There is huge potential for the game to grow further, but [..] there needs to be serious investment into women's football, in its finances, in its infrastructure, and in the administration of the game”

In the USA, the most developed women's football market, half the teams in the NWSL have no affiliation to a men's team, meaning there is a greater focus on providing better quality, higher capacity stadia and delivering strong match attendances. The result is the highest average capacity for women's football globally and strong growth in attendance in recent years, leading to an average capacity utilisation of 44.7% in the 2019/20. In Europe, utilisation is lower, due to their lack of appropriate stadia.

The NWSL leads the way amongst major women's leagues for average capacity, attendance and capacity utilisation

Broadcasting revenues: not keeping pace with growing interest

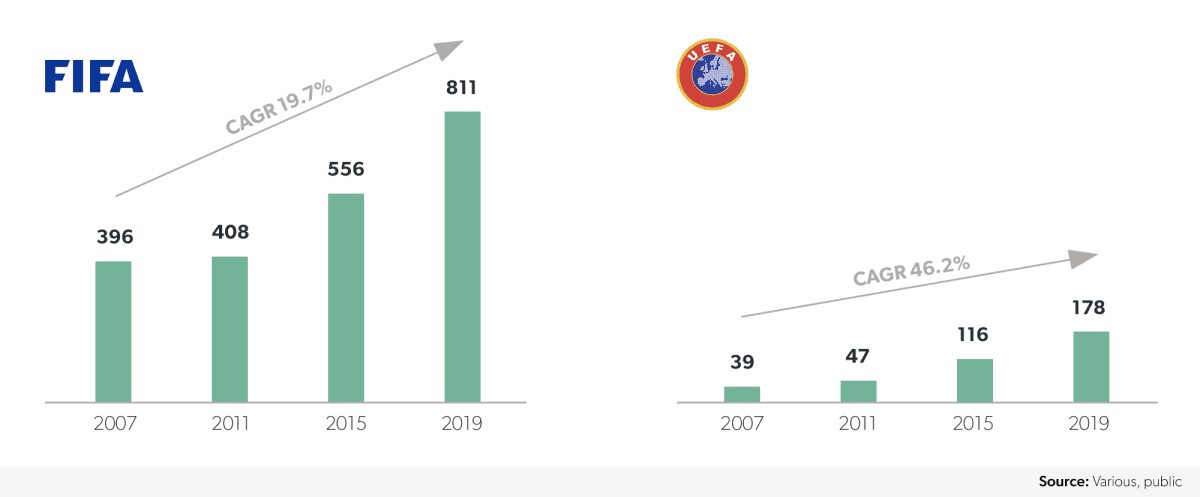

Viewership figures have similarly increased in recent years, however, much like matchday attendances, are driven by the higher interest in international matches than in domestic games, where audience figures are enjoying solid growth – 19.7% and 46.2% for WWC and European Championship tournaments respectively.

While Women's World Cup audiences are higher, those of the Women's Euros are growing over twice as fast

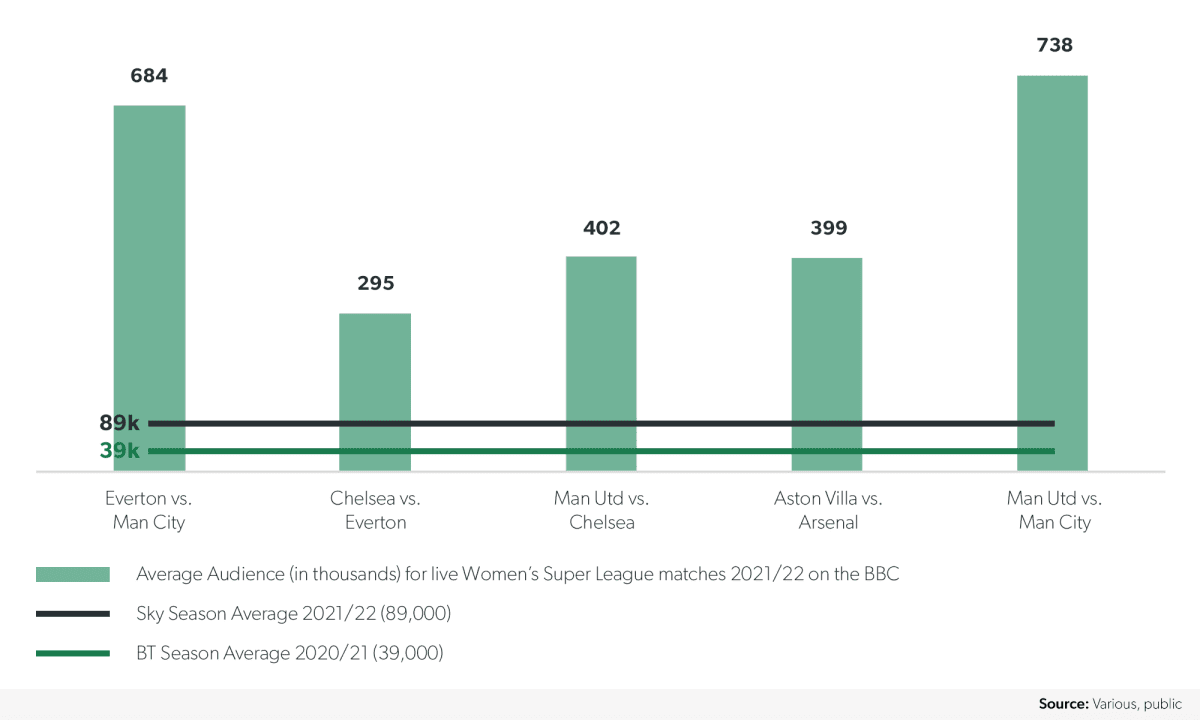

The fact that most women's international tournaments are available through free-to-air (FTA) broadcast contributes to their high viewership figures. England's WSL has attempted to broaden appeal via a hybrid paid-and-FTA approach in partnership with the BBC and Sky Sports. A significant rise in viewership has resulted – heavily driven by the BBC matches – to an estimated 8.9m, 89% of which had not seen a WSL game before. The question remains whether these supporters can be persuaded to pay for women's football matches and bring a much-needed boost in revenues to the game.

Free-to-air matches attract much higher audiences, though paid viewership has more than doubled in 2021/22

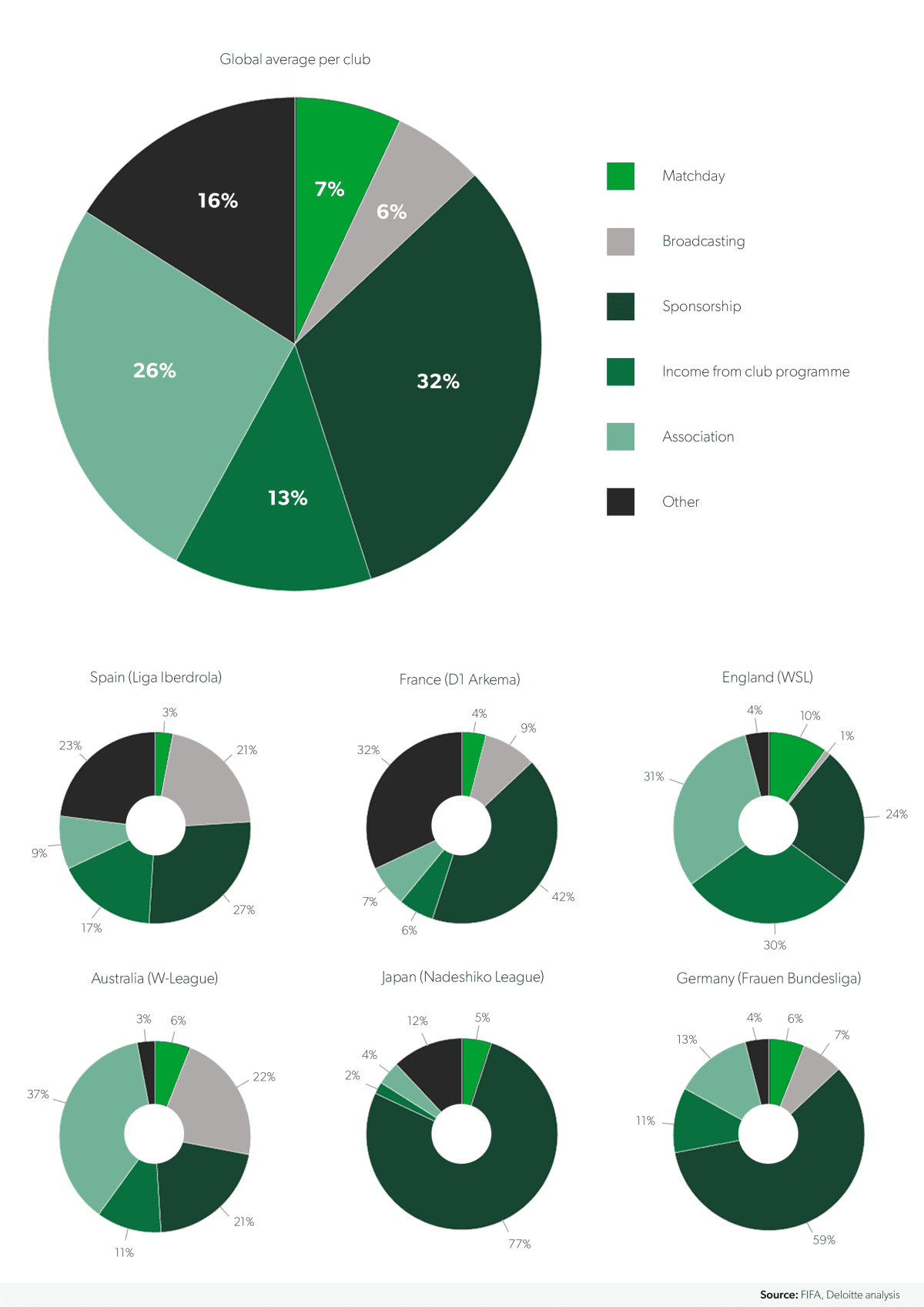

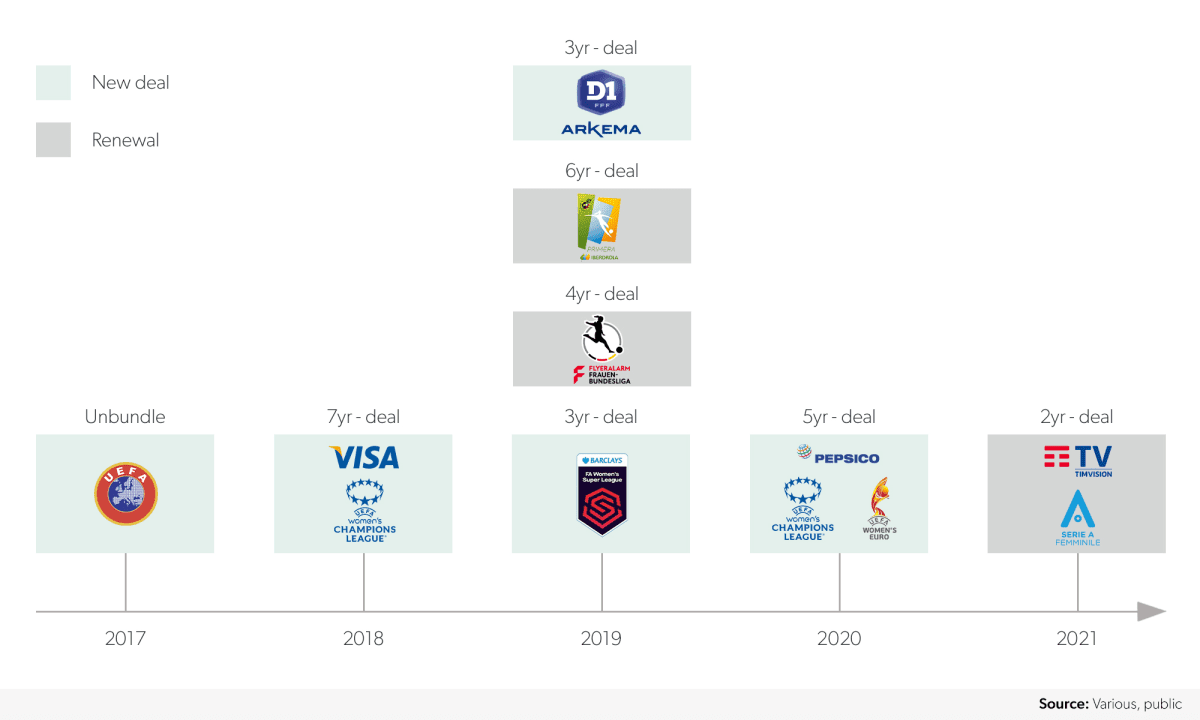

Recent years have seen an acceleration in broadcasting deals negotiated for women's leagues. In addition to the WSL, the German, French, and Italian leagues have all negotiated new broadcasting deals since 2017. Nonetheless, domestic league broadcasting rights only account for a relatively small share of total revenues: 6% according to data from FIFA and Deloitte (2018/19 season), falling to only 1% in England's WSL. This clearly represents an area of significant growth potential. Importantly, unbundling women's broadcasting rights from men's tournaments has been shown to work. Negotiating broadcast rights exclusively for women's teams generates on average 7x more in revenue from broadcasting ($700k) than leagues who negotiate rights alongside their men's competition. UEFA successfully unbundled their rights away from the men's tournaments and has led to the DAZN and YouTube rights acquisition worth $8m, according to Bloomberg.

Sponsorship accounts for the largest share of club revenues, broadcasting the smallest

DAZN's acquisition signals a desire to align women's football with sports consumption trends. Overall, OTT has seen a 94% increase in average time spent consuming live sports, chiefly among younger consumers. Alongside this growing demand, women's football has shifted towards broadcasting more matches online, taking advantage of their younger consumer base and flexible rights model. As 40% of sports viewers are deterred by women's sport's lack of media coverage, OTT offerings should help in growing the game and reducing these barriers to entry.

Various leagues have begun providing OTT platforms, including the FA Player broadcasting live WSL games online, and NWSL's deal with Amazon-owned platform Twitch. The 24% of leagues with an OTT platform report higher broadcast deals on average per annum (US $800k vs US $300k). These leagues also generate greater total league revenue (US $4.3m vs US $2.6m). In addition, several dedicated women's football streaming platforms have also emerged, such as ATA Football, which broadcasts Champions League matches and major European leagues for fans in the USA and Europe. At the time of writing, 97% of women's football leagues broadcast matches either on linear TV or via a streaming platform, with 53% offering both.

These encouraging movements in the broadcasting rights market for women's football represent broadcasters reacting to a growing consumer demand. However, the fact that broadcasting remains such a low proportion of women's club revenue indicates that more can be done to provide women's football with the broadcasting status that its high demand deserves.

Sponsorship growth driven by exclusive negotiation

As shown in the above data, sponsorship accounts for the largest share of revenues in women's football at 32%, rising to 59% in Germany and 77% in Japan. As in broadcasting, several new league naming rights deals have been agreed in the last three years. Barclays' acquisition of WSL naming rights is worth a reported £10m, the largest-ever investment in UK women's sport by a single brand.

The number of women's league sponsorship deals has increased in recent years

A significant proportion of clubs negotiate a number of their sponsorship contracts exclusively for their women's team, and in doing so generate twice as much in sponsorship revenue according to FIFA. The importance of sponsorship as a revenue stream is illustrated by the fact that the top clubs by turnover generate 53% of revenues through sponsorship, while 70% of total revenue generated by the most profitable leagues is also from sponsorship. More than 50% of women's team sponsors are now exclusive to women's teams, allowing them to distinguish themselves from their respective men's teams to appeal to a younger, more family-oriented audience. Although gambling companies account for 45% of front-of-shirt sponsorships in the men's Premier League, the equivalent figure for Premier League club's women's teams is only 15%, suggesting that women's football is seen by advertisers as a unique and different asset.

On the international stage, VISA and Nike have signed long-term deals to sponsor UEFA Women's tournaments exclusively since their sponsorship unbundling in 2017. Traditional UEFA sponsors such as Heineken and PepsiCo have added the women's tournaments to their existing men's sponsorships. These deals demonstrate the growing ability of women's tournaments to attract large-scale sponsors exclusively and the growth potential within this sponsorship space.

By contrast, FIFA's sponsorship model continues to be a bundled package, combining men's and women's tournaments. However, FIFA offers fewer sponsorship tiers to the WWC (two) compared with the men's WC (three). One tier is shared across both tournaments, offering the WWC just one tier for brands to sponsor the women's tournament exclusively.

Overall, unbundling rights from men's tournaments allows women's tournaments to attract their own sponsors for a distinct target market and providing a crucial revenue stream separated from men's teams. Due to sponsorship's large proportion of women's club's revenues, increased sponsorship into the women's game allows for clubs to gain important capital, allowing brands to connect with the overall message of gender parity. As more rights are unbundled, Deloitte predicts that all women's teams should have at least one sponsorship agreement distinct from the men's team by 2023, demonstrating the attractiveness of women's football for brands.

Despite positive commercial growth, questions remain

Women's football is showing a significant amount of growth potential, as seen in its high broadcasting figures and the growing involvement of major brands in the sport. The acceleration of exclusive broadcasting and sponsorship deals into women's football demonstrates the capabilities of the game to attract deals independently and have allowed it to grow commercially. Various governing bodies have placed women's football central to their strategies.

The key question centres on governance, and specifically on affiliation to established men's clubs. The women's leagues vary in the extent to which female teams are tied to a male counterpart.

The WSL is the only major league without an independent team

The available data suggests that women's football should be allowed to grow distinctively from men's football. Despite the high interest levels into women's football, attendances have been hindered by the lack of dedicated infrastructure, which, in turn, suffers due to the current governance model's dependence on men's teams. A key question is therefore whether separation from the men's game could be more appropriate to facilitate faster, organic growth in women's football.

Although affiliated women's teams are provided with significant brand value from their men's team, independent teams are still able to capitalise on the high interest levels surrounding women's football. The NWSL is a case-in-point, attracting broadcasting opportunities and sponsorship revenue, while demonstrating high match attendances and elite-level footballing quality, with only 50% of their teams affiliated to a men's team in 2021. This proportion will increase to 58% in 2022 with the introduction of two new teams. The NWSL is also attracting outside investors, as demonstrated by soon-to-be-launched independent club Angel City FC and is starting to take bigger steps in infrastructure as shown by Kansas City Current.

As attention begins to turn to the Women's Euros in England in 2022, governing bodies are at a crossroads. Women's football has provided high interest levels and demonstrated commercial potential, but more should be done to develop the sport's ecosystem, administration, and infrastructure to strengthen its growth trajectory and address its underlying challenges.